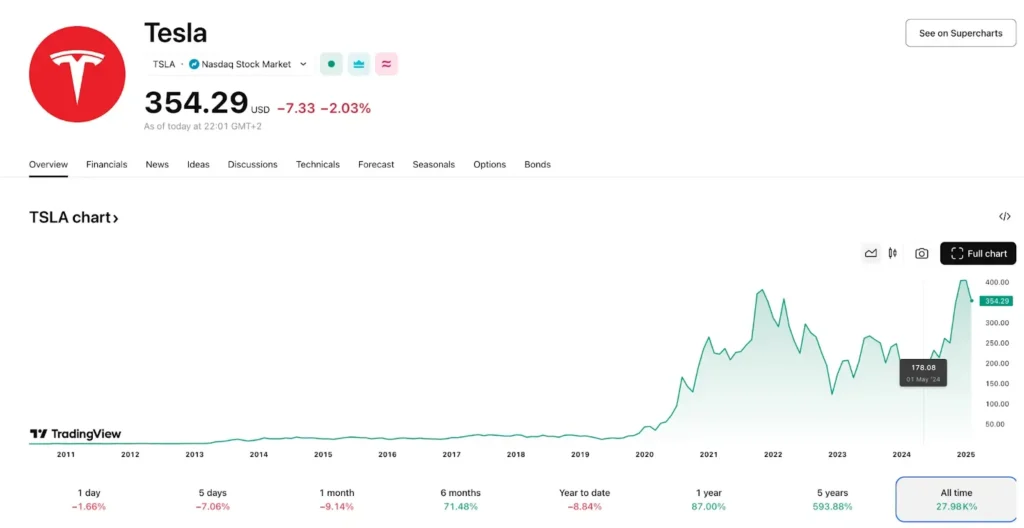

Tesla Stock in 2025: Still a Smart Investment or Time to Exit?

Tesla’s Story in 2025: A Turning Point?

Tesla, Inc. (NASDAQ: TSLA), the world’s most talked-about electric vehicle (EV) company, has reached a critical point in its journey. With new competitors entering the EV space, slowing growth in some key markets, and continued controversy surrounding its CEO Elon Musk, investors are asking one big question—should you still bet on Tesla stock in 2025?

Related article: EV Trends in 2025 – IndeedWords

The Financial Landscape: Slower But Still Profitable

Tesla’s recent financials show a mix of strength and growing pains. In Q1 2025, the company posted $19.3 billion in revenue, down from $21.5 billion in the same quarter last year. Net income took a sharper dive—dropping 71% year-over-year due to rising production costs and softening demand in China and Europe.

Read more: Tesla Financial Reports | Top Growth Stocks Slowing Down – IndeedWords

Elon Musk: The Brand and the Burden

Elon Musk remains Tesla’s most valuable asset and its most controversial liability. His ventures with X (formerly Twitter), Neuralink, and SpaceX often distract from Tesla’s core business. More recently, his political engagement stirred criticism, causing institutional investors to raise concerns about focus and leadership.

Discover more: Tesla AI Day | CEO Reputation and Stock Performance – IndeedWords

Product Innovations: Progress and Pitfalls

Tesla has had mixed success with its product roadmap this year. The Cybertruck, a highly anticipated model, finally hit the roads in late 2024—but with hiccups. Multiple software glitches and lower-than-expected range disappointed some early adopters.

Visit: Tesla Vehicle Models | Battery Wars in the EV World – IndeedWords

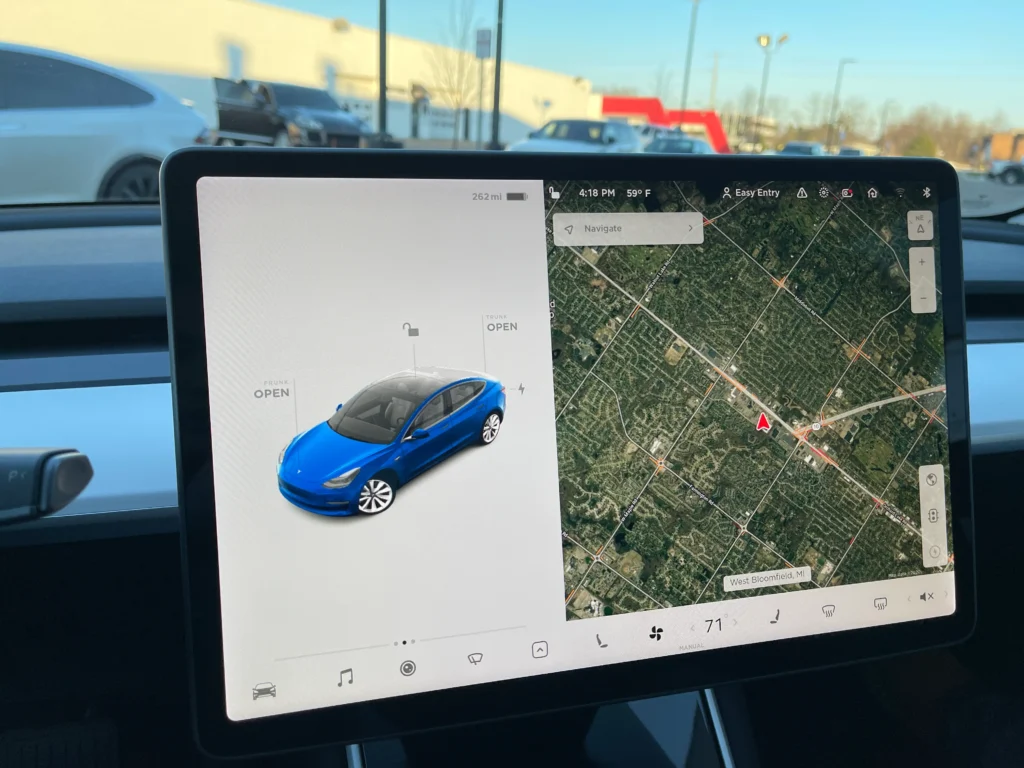

Autopilot and FSD: Vision vs. Reality

Tesla’s Autopilot and Full Self-Driving (FSD) software remain under scrutiny. While beta programs are expanding, regulatory bodies in Germany and California have pushed back, labeling the system as unreliable for full driver autonomy.

Learn more: Tesla Autopilot | Legal Challenges in Self-Driving – IndeedWords

Tesla Energy and AI: Hidden Value Drivers

Beyond cars, Tesla is building powerful businesses in energy storage, solar power, and AI infrastructure. The Megapack project, for example, is gaining momentum globally. Additionally, Tesla’s Dojo supercomputer is designed to handle AI training for self-driving and robotics, offering future revenue streams.

Explore: Tesla Energy Products | AI’s Role in Tesla’s Future – IndeedWords

Global Competition and EV Market Shifts

Tesla is no longer the lone wolf in EV innovation. Companies like BYD, Lucid Motors, Rivian, and Volkswagen are catching up quickly. In China, local brands are taking Tesla’s market share, and in Europe, stricter regulations and strong local competition create new hurdles.

Stats: EV Sales Insights | Tesla vs Rivals – IndeedWords

Investor Sentiment: Buy, Hold, or Sell?

Wall Street remains split on Tesla stock. Bulls point to long-term growth, brand loyalty, and Musk’s innovation pipeline. Bears highlight valuation concerns, market saturation, and leadership distractions.

See also: Tesla Analyst Forecasts | Evaluating Risk in Stocks – IndeedWords

Risks That Could Derail Tesla

Risks include leadership distractions, regulatory fines, supply chain issues, shrinking profit margins, and brand fatigue. These are not deal-breakers—but they are real.

The Verdict: Is Tesla Stock Still a Buy in 2025?

Tesla’s story is no longer about rapid growth. It’s about mature innovation, market resilience, and Elon Musk’s execution. The stock isn’t cheap, nor is it predictable. But if you’re betting on a future shaped by EVs, AI, and sustainable energy—Tesla remains a top contender.